Opportunities brought by ETH2.0 upgrade

Nov 19, 2024

What is ETH2.0?

Compared with ETH1.0, ETH2.0 is not just to patch up the original network, but to create a brand-new system including casper consensus, fragmentation technology and new virtual machines, complete the transformation of consensus mechanism from POW to POS, realize the improvement of performance and rate reduction of Ethereum network, and endow it with the ability to carry financial projects and support business application scenarios as an infrastructure in the future. This upgrade is divided into several stages, and each stage will take some time to realize. Whether it is the time and technology required for the upgrade, or the great improvement of its function after the upgrade, we can compare the upgrade event of the Ethereum network to the replacement of 4G to 5G, and the subversion and innovation from ship to aircraft carrier.

Progress and technical impact of ETH2.0

ETH2.0 was originally planned to be released on December 1st, and on the morning of November 24th, the precondition that 16,384 verifiers were required to pledge a total of 524,288 ETH to start the "0" phase was achieved.

Since the pledge condition has been reached seven days in advance, the "0" phase will be officially launched on December 1, and the beacon chain will be created. ETH1.0 will begin to transition to 2.0, and the two chains will coexist before the transition is completed. The whole transition process will take several years. After the transition is completed, the ETH1.0 chain will become a fragment of the 2.0 network, which is equivalent to the original chain being merged into a part of the new chain.

The new ETH2.0 chain will also have a new token-beth. If you want to migrate assets, you need to destroy the token on the old chain through the staking mechanism and generate Beth in the new chain. The original chain of ETH can still be used, and you can choose not to migrate assets. The process of asset migration is irreversible. Once the migration is confirmed, the records on the ETH1.0 chain will be destroyed and cannot be migrated back to the original chain.

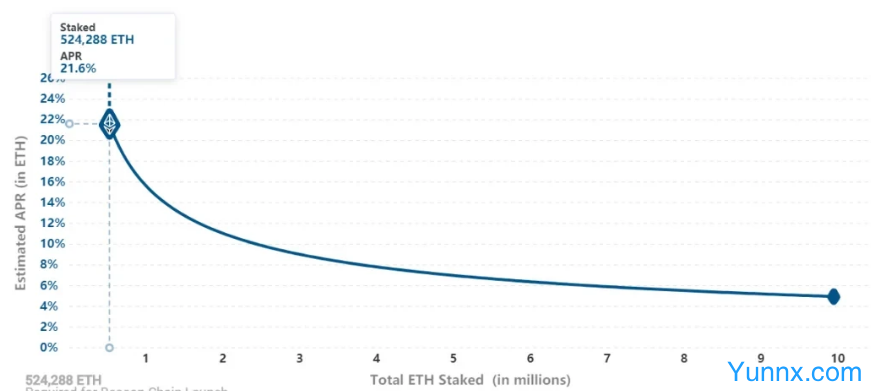

Different from eth, beth can participate in mining and get mining rewards. When the eth pledge of the whole network reached 524,288 pieces and the main network was started, the annualized rate of return of miners was 21.6%. With the increase of pledge value, the annualized rate of return will decrease. According to the curve, when the pledge value reaches 10 million eth, the annualized rate can be maintained at around 5%.

Investment opportunities brought by Eth2.0

The impact of the release of Eth2.0 will appear in all aspects, among which what are the most relevant to investors?

1. 2.0 Network's influence on the price of ETH tokens

For investors who hold eth or want to hold eth, the most concern is the recent price impact of the release of ETH2.0 on ETH tokens. Network upgrade needs to pledge and lock a certain amount of eth. The amount of eth lock assets continues to increase on the existing basis, and the lock time is longer, which leads to a decrease in the supply of this currency in the market and may bring short-term price increases.

2. 2.0 The price impact of the network on other currencies

At the same time, due to the transformation of the blockchain network consensus mechanism, a large number of ETH mining machines have lost their efficacy, and the delayed mining machines will bring new development opportunities to other token under the POW consensus mechanism. For example, when the mining machine turns to dig etc, it will inevitably bring attention to the corresponding currency, thus creating a certain premium space, which is also some investment opportunities that investors can examine and wait.

3. Participate in eth pledge and get mining reward.

As mentioned above, the pledge of eth will bring some benefits, specifically, the adoption of POS algorithm in Ethereum network will reward the block nodes, and the verifier can get some benefits.

After understanding the benefits, we also need to understand the costs and risks of participating in the pledge in order to make a steady profit in the eth2.0 upgrade.

Costs of participating in eth pledge:

① There is a certain threshold for the pledge of eth. To build a personal node, it is necessary to have a certain ETH asset base and a machine with good performance. ② If you participate in the pledge through a third-party service provider, the participation threshold will be lowered, but you need to pay a certain service fee, and at the same time, you need to clarify the risks. Don't blindly follow the trend.

Risks of participating in eth pledge:

① The lock-up time may be as long as several years, and the pledger needs to bear the price fluctuation risk of eth because the transaction cannot be conducted during this period; (2) Once the pledge is started, you need to perform the corresponding duties as a verifier, and if there are abnormal nodes, there will be penalties such as fines; (3) The risk of eth being stolen due to the attack on the contract loopholes existing in pledge cannot be ignored.

Summary: At present, the "0" phase started on time, but it will take a long time to get to the real main online line. Recently, the core developers have discussed that the second phase is planned or put on hold, which indicates that the completion of ETH2.0 may not be as smooth as expected. Although the construction of aircraft carrier is a long road, its achievements will carry important functions in the future, so the realization of grand vision is worth waiting and expecting, and we should also give more time and support to the development community. Whether it resonates with defi or as the public chain of infrastructure, we will wait and see how the Ethereum network will play its unique role as the cornerstone of the new generation of Internet.

Recommend Apps