Trump Coin price prediction

Jan 20, 2025

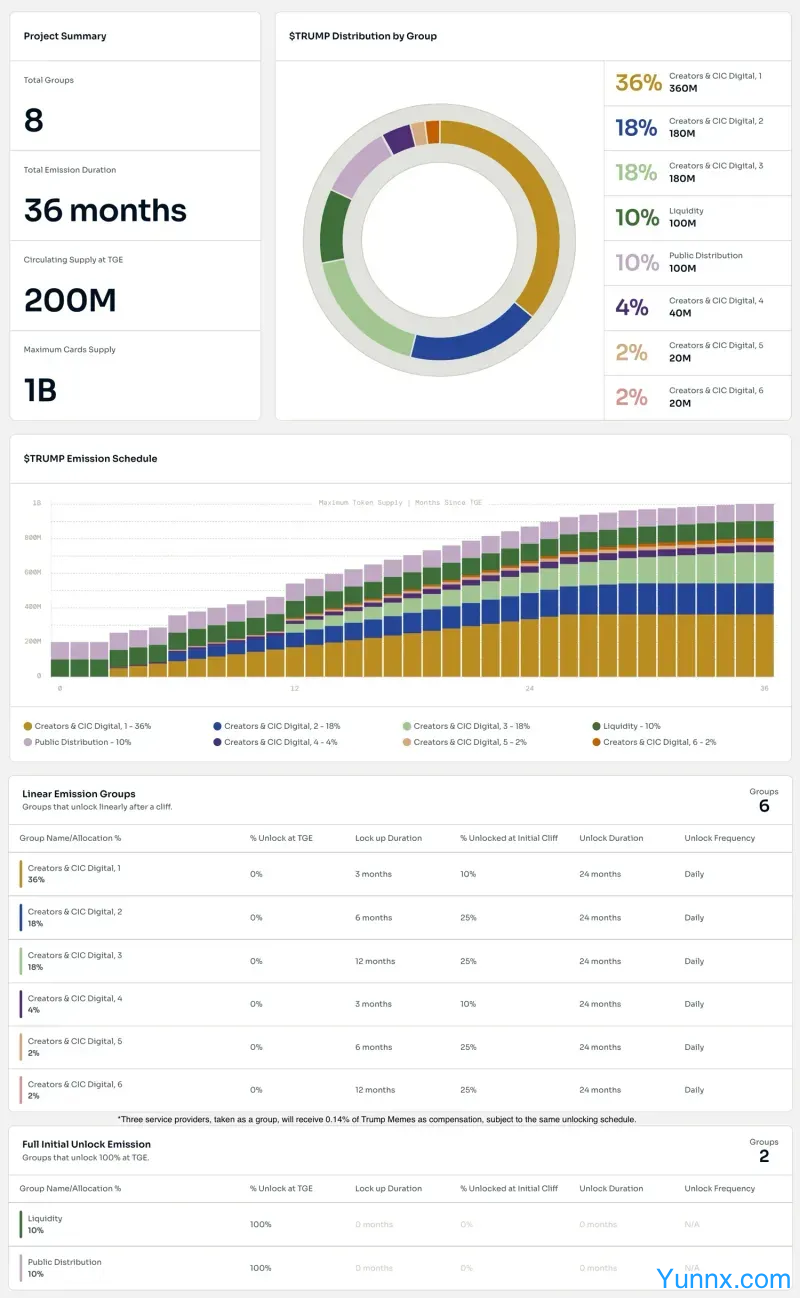

TRUMP Coin (also known as OFFICIAL TRUMP) is a personal Meme coin announced by former US President Donald Trump. Since its release on January 18, 2025, this cryptocurrency has experienced significant price fluctuations and changes in market sentiment. In order to make reasonable predictions about the future price of TRUMP Coin, we need to comprehensively consider its historical performance, market trends, and potential influencing factors.

Trump coin launch price

The issuance price of TRUMP Coin was determined on January 18, 2025, when former US President Donald Trump announced its launch. According to data from multiple sources, the opening price of TRUMP Coin (also known as OFFICIAL TRUMP) is $0.1824. This price marks the starting point of this cryptocurrency entering the market and quickly attracted high attention from global investors.

Trump meme coin price history

According to data provided by Yingwei Caiqing, TRUMP Coin showed astonishing growth momentum in the early stages of its launch. The opening price was 0.1824 US dollars, which quickly climbed to around 30 US dollars in just a few hours, with an increase of over 1250%. However, with the rational return of the market, the price of TRUMP Coin began to rebound, but even so, it remained at a relatively high level. It is worth noting that the price trend of TRUMP Coin is not non-linear, but accompanied by multiple large fluctuations, showing extremely high speculation and uncertainty.

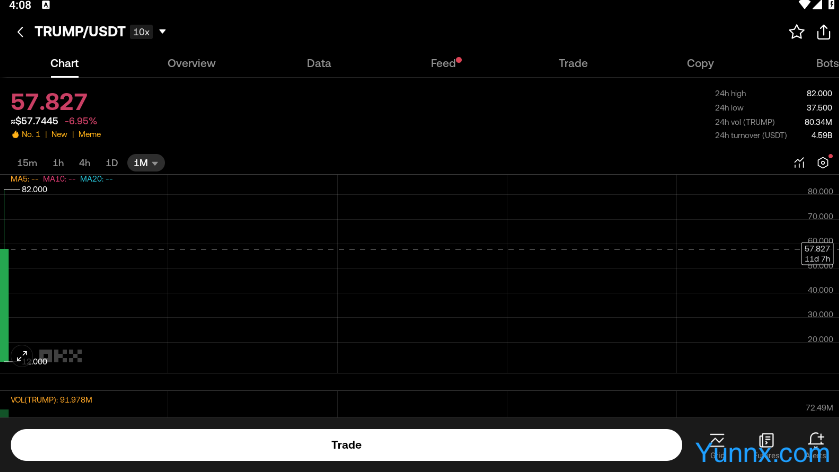

Trump meme coin current price

The current price is fluctuating in real-time. I suggest everyone download OKX to stay updated on the price of Trump meme coin in real-time.

Trump Coin price prediction

Market sentiment and liquidity

The success of TRUMP Coin largely relies on the public's support and personal charisma towards the person behind it - Donald Trump. As a highly controversial political leader, Trump has a huge fan base, which has brought a lot of attention and purchasing power to TRUMP Coin. In addition, TRUMP Coin has been listed on multiple mainstream cryptocurrency trading platforms such as Binance and Coinbase, further enhancing its liquidity and market recognition.

Technical analysis

From the technical chart, TRUMP Coin exhibits typical high volatility characteristics. In the short term, TRUMP Coin may continue to be influenced by market sentiment and technical indicators. For example, if TRUMP Coin can break through the recent resistance level, it may initiate a new round of upward trend; On the contrary, if it falls below the support level, it may trigger a new wave of selling. Therefore, investors should closely monitor key technical support and pressure points, and judge the strength of the market based on changes in trading volume.

Fundamental considerations

In addition to technology and market sentiment, the fundamentals of TRUMP Coin are also worth paying attention to. Firstly, the attitude of Trump himself and his team towards TRUMP Coin is crucial. Any positive or negative news can lead to drastic price fluctuations. Secondly, changes in the regulatory environment will also have a significant impact on TRUMP Coin. Although TRUMP Coin claims that it is not an investment tool or security, it is inevitably subject to regulatory scrutiny. Finally, the macroeconomic situation and the performance of other cryptocurrencies will indirectly affect the price trend of TRUMP Coin6.

Long term outlook

Considering the highly speculative nature of TRUMP Coin, its future value direction is full of uncertainty. On the one hand, if Trump can win the upcoming election, TRUMP Coin may receive more policy support and development opportunities; On the other hand, as more and more celebrities and institutions join the cryptocurrency field, market competition will become more intense. In addition, with the increasing regulation of cryptocurrencies worldwide, the challenges faced by TRUMP Coin cannot be ignored.

Risk statement

It must be emphasized that TRUMP Coin is a high-risk investment product with significant price fluctuations and a lack of intrinsic value support. Investors should fully recognize the risks involved before participating and take corresponding risk management measures. For example, setting stop loss points to limit maximum losses, diversifying investment portfolios to reduce the risk posed by a single asset, etc.

Recommend Apps